Updated on July 17, 2019

Speaking Out as a Woman of Color

Jotie Mondair speaking at the 2019 Commencement, Notre Dame de Namur University

Trump’s recent tweets suggesting that women of color in the U.S. Congress should “go back to where they came from” have made me think about how many ways we can be silenced—by perpetuating racist tropes, by insinuating a lack of intelligence, by not giving us the floor to stand up and speak. When I was doing (way too much) research on these tweets I thought of the gut-punching comment that my professor Dr. Sanders left in one of my response journals for her class in the Art Therapy master’s program I recently finished at Notre Dame de Namur University. Dr. Sanders’ responded to my writing that I was frustrated by the group dynamics in the class: “Did you say something?” I read it over and over again—did I say anything? Of course I didn’t! That felt like a call to action. I vowed to no longer take part in the silencing of women of color, particularly since I am also the child of immigrants, and a survivor of sexual assault.

I’m also one of a large number of people who are afraid of public speaking. In high school, I would panic before any presentation in front of my peers. My brain was instantly consumed by thoughts like, “What if I mess up on a really simple word?” or worse, “What if I get so nervous, I pee my pants?”

The Art Therapy master’s program at Notre Dame de Namur required many presentations that helped me overcome those fears. Our instructor Sarah Kremer had us watch videos on how TED Talks follow a formula to make them intriguing and convincing. She then had us do our own mock TED Talk in front of the class. Before my oral qualifying review, a presentation in front of family, friends, and faculty about my experience in the field, Dr. Satterberg gave me a stone to hold during the presentation to help reduce my anxiety while I shared difficult stories about working in a psychiatric hospital. The stone grounded me by bringing my awareness to the present moment. Before most presentations, I also colored mandalas, painted with gouache, or knitted to help ease my anxiety—art therapy is not just for kids. Since I was always preaching the benefits of art therapy for anxiety and stress reduction, I figured it would be a great time for me to practice the skill for myself. (Fun fact: it worked!).

When I received an email that I was nominated to try out to be a student speaker at my university’s Commencement, I thought long and hard about what it would mean to speak before more than a thousand people. So long and hard that I almost forgot to send in a proposal, but thankfully, Linnaea Knisely, the executive assistant to the Office of the Provost, saved the day! I tried out, and to my surprise, I was selected as the speaker to represent the graduate students.

The day of Commencement I spoke to a full crowd on our university’s sports field about my parents’ experience coming to the United States and how their sacrifice and determination played a major part in my success. I found it critical to include them in this moment and highlight my experience as a woman of color from an immigrant family because I decided on election day in November 2016 that I would no longer allow myself to be silenced or misrepresented.

Since 2016, I’ve made it a personal goal to try and speak publicly as much as possible. I’ve given presentations about my thesis research at the National Conference on Race and Ethnicity in American Higher Education (NCORE) and will be presenting at the American Art Therapy Association (AATA) 50th Anniversary Conference, as well as sharing my experiences with people who do not look, think, or live like me. For me, the fear of public speaking came and went when I realized someone or something was threatening my ability to speak out.

Don’t get me wrong, I still get nervous before presenting, but I’ve found that creating art, drinking chamomile tea, and eating a lot of dark chocolate helps reduce the pre-presentation anxiety. I speak often with people who support me, and who can offer me guidance and perspective—all that keeps me going.

Jotie Mondair is a recent graduate of the master’s program in Art Therapy at Notre Dame de Namur University. She is currently working as an Associate Marriage and Family Therapist at Fremont Hospital.

For information on applying to Notre Dame de Namur University, please visit the Admissions page.

Updated on June 3, 2019

Three-Sport Athlete Brings Competitive Spirit to Fundraising for Ugandan Youth

Arianna Cunha, center, with Youth Sport Uganda coworkers Bonita Komug (left) and Lorna Letasi (right)

Arianna Cunha doesn’t do things halfway. When she was being recruited as a student-athlete growing up in Hayward, California, she wanted a college that would allow her to play both basketball and soccer. She chose Notre Dame de Namur University (NDNU) in Belmont, California.

Arianna not only played her two chosen varsity sports, she joined the track team in her senior year and ran both the 100 and 200 meters. “I’m somebody who likes a taste of everything,” she says. Arianna has always been an avid athlete. “Growing up, my sister and I were involved in every sport you can think of.” Why does Arianna like sports so much? “I love to compete,” she says. “Plus I enjoy the dynamic of a team. It’s like having another family, another set of people you can rely on and trust.”

She majored in Kinesiology at Notre Dame de Namur, where she graduated in May 2019. Arianna is fascinated by the field of public health. Her interest led her to apply for an internship in Africa. Arianna was accepted to a program in the summer of 2018 with Youth Sport Uganda, an African nonprofit that promotes sports, health, and education in a fun setting. She used all the money she got for her 21st birthday to pay the travel expenses. Arianna worked in programs in Kampala, the capital of Uganda, to engage young people in sports while teaching them about healthy lifestyles and disease prevention.

“We realized that to really address health issues in Uganda, we had to get the parents involved as well,” Arianna describes. “I helped create and implement a program to give classes to the parents of the young people in the education program.” Arianna worked alongside Ugandan interns to present information to mothers about preventing disease and providing healthy nutrition.

“It wasn’t easy leaving after three months in Uganda,” Arianna says. “The last week was very emotional. I learned so much from the young people and their moms about hospitality and family bonds.”

When Arianna returned to Notre Dame de Namur University in fall 2018, she decided to incorporate her experience in Uganda into the athletics program. “The student athletes at NDNU raise funds every year for a cause that we decide on,” she explains. “I talked about Youth Sport Uganda, and the students voted to make them the fundraising recipient for the whole athletic program for the 2018–19 academic year.” The funds will have significant impact in Uganda, where an annual student scholarship costs roughly $400. The fundraising drive concluded in spring 2019, netting $1800.

“Now that I’ve graduated, I’m leaving college with a direction for my career,” she says. “The internship in Uganda, as well as the past four years as a student leader and athlete, have helped me become a problem solver. With those skills, I’ve chosen to pursue a graduate degree in public health.” Arianna has been accepted into a master’s program in public health, and will be a summer intern at the San Francisco Department of Public Health.

For more information on applying to Notre Dame de Namur University (NDNU), please visit the admissions page.

Updated on May 17, 2019

The Bohemian: Notre Dame de Namur University’s Literary/Arts Magazine

The Bohemian’s editorial board, at a lighter moment

Notre Dame de Namur University (NDNU) has a long tradition of publishing literary/arts magazines, edited by students. The current magazine, The Bohemian, started in 1991, and the latest issue was just published this past spring.

The new issue, with full-color printing and almost 100 pages of content, includes fiction, poetry, nonfiction, and artwork by Notre Dame de Namur students and faculty, as well as writers outside the university.

A new feature in this issue is work by students at San Mateo County’s Juvenile Hall, where NDNU students have been tutoring young people and working with them on their writing. The incarcerated youth tell unforgettable stories about the obstacles they have faced at an early age: earning a living at age nine, dealing with a parent’s deportation, struggling with untreated ADHD and mental health issues.

Notre Dame de Namur University students can work on The Bohemian magazine through a course where they receive credit, or they can participate in editing and production through a campus club. The editorial meetings often include 15 to 20 participants, a great opportunity to hone teamwork skills. According to Diana Molina, a senior who worked on this year’s issue, that number did not produce contention: “We managed to work together well, despite the size of the editorial board. The editors tried to stay open-minded, taking into account that everyone has a different writing style.”

Diana also feels that her social media skills improved as a result of working on The Bohemian. “I was the social media manager, and we expanded the magazine’s reach on Instagram and other platforms this year,” she says.

Faculty advisor Professor Pearl Chaozon Bauer feels that working on The Bohemian is instructive for students in many ways: “In producing the magazine, the students learn to be better critical readers as well as expand their appreciation of different modalities of art. But what I like best about The Bohemian is that the students can really feel that they are part of an effort that produces something of value. It’s an experience they will always remember, and having a copy of the volume reminds them of their hard work and teamwork.”

The spring launch event for latest issue of The Bohemian had a great turnout of 60 participants. Students took part in an open mike, reading their contributions to the journal.

“Not that many colleges still have a print magazine with the high-quality production values of The Bohemian,” Diana says. “It’s something you can feel really proud of.”

For more information on applying to Notre Dame de Namur University (NDNU), please visit the admissions page.

Updated on April 8, 2019

Notre Dame de Namur University Kinesiology Majors Going on to Careers in Physical Therapy

Kinesiology—the study of the mechanics of body movements—is one of the top five majors at Notre Dame de Namur University. Recent graduates of the major are planning careers as physical therapists with exciting specializations. The students have been accepted to leading graduate programs in the field.

Nathan Arturo Iruegas will be attending University of Southern California (USC) in fall 2019. U.S. News & World Report ranks USC as the #1 doctoral program in physical therapy in the United States. Nathan has a very specific population he hopes to work with: “I would like to grow my knowledge of chronic neuromuscular conditions such as Parkinson’s disease, and build on current methods of treatment to provide patients with an improved quality of life,” he says. “I’ve been through physical therapy myself, and I want to give that feeling of independence back to people.”

Madeleine Orellana will also be enrolling at USC in fall 2019. “After my doctoral program I’m eager to specialize in sports and orthopedic physical therapy,” she says. “I aspire to become a sports physical therapist for a professional team.” Madeleine has been involved in athletics her entire life and played varsity volleyball at Notre Dame.

Megan Kravec was admitted to several graduate schools, including New York University. She opted to study closer to home and will be attending the doctorate of physical therapy program at California State University, Fresno, which also has a program in hippotherapy. “My goal is to treat children with special needs, and veterans, using hippotherapy,” she explains. Hippotherapy is the use of horseback riding for rehabilitative treatment to improve coordination and strength. “Coming from a military family, I would like to give back to our veterans.”

Robert Lee Keith III is attending the doctoral program at The Ohio State University with a full scholarship and a stipend. “My goal is to become a pediatric physical therapist and help underserved populations,” Robby says. He grew up in Eastside San Jose, and he’s personally seen the need for children to have greater access to healthcare.

“We’re extremely proud of the accomplishments of these Notre Dame graduates,” remarks Jennifer Kinder, program director of the Kinesiology major. “We’re excited for their contributions to society and to the fields of kinesiology and physical therapy.”

For more information about Notre Dame de Namur University’s undergraduate program in Kinesiology, visit the webpage. For information on how to apply, see the Admissions page.

Updated on April 1, 2019

Career Change to Teaching: Traci Yerby Shifts from Biotech to the Classroom

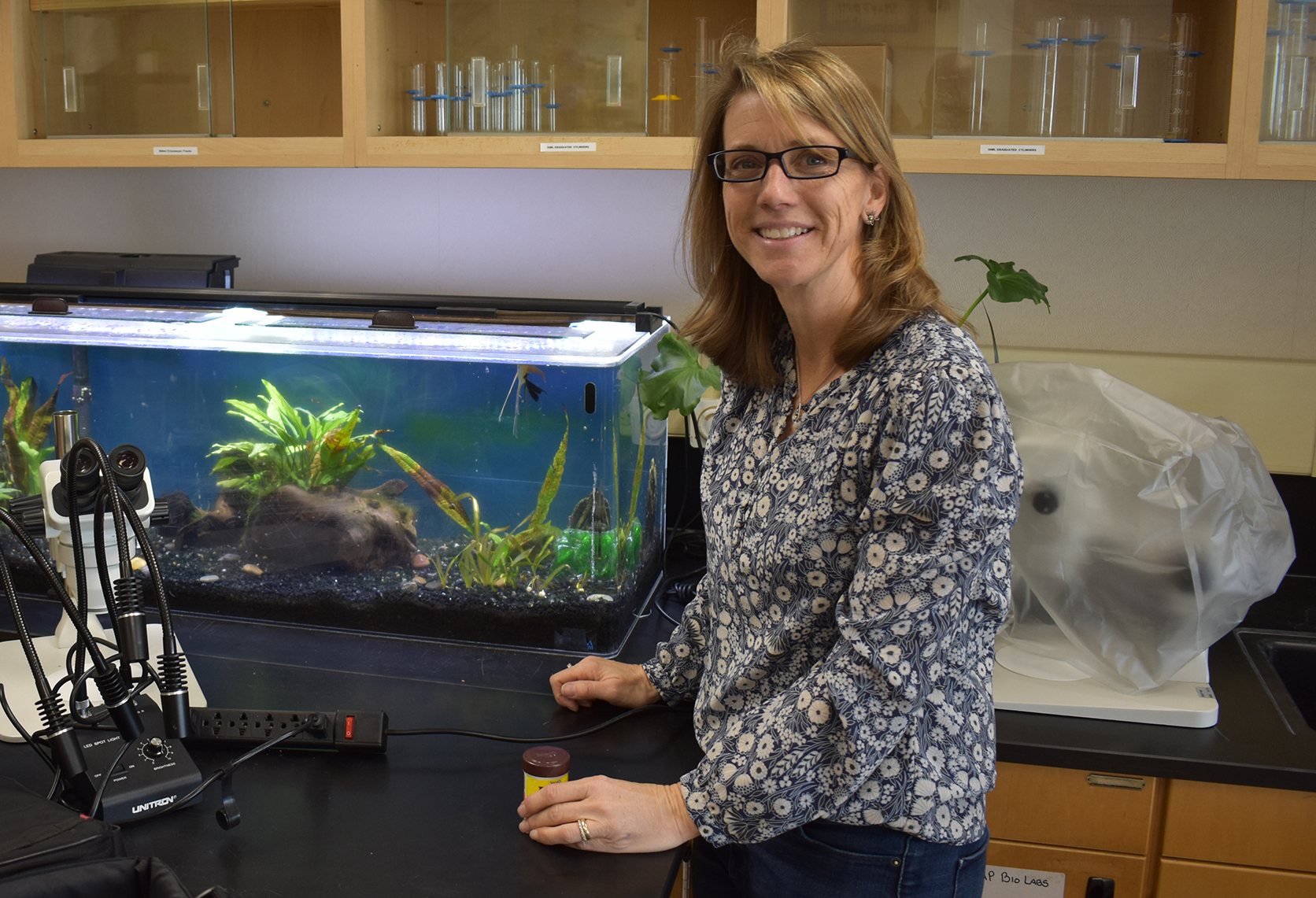

Dr. Traci Yerby, NDNU Alumna and High School Teacher

Traci Yerby worked in the biotech industry in Silicon Valley after earning a PhD in microbiology at University of California, Davis. She had a successful career in stem cell research, corporate development, product management, and marketing. After she and her husband started a family, she took time off, and the principal at her children’s elementary school asked her if she would teach science to the kids on a part-time basis.

“At first I taught just as a lark, without a credential,” said Traci. “It was the most fun I’d had in a long time.” The principal and some of the teachers encouraged her to think about teaching as a career. She had some experience both as a teaching assistant in grad school, and as an adjunct faculty member at state universities.

“At first I taught just as a lark, without a credential,” said Traci. “It was the most fun I’d had in a long time.” The principal and some of the teachers encouraged her to think about teaching as a career. She had some experience both as a teaching assistant in grad school, and as an adjunct faculty member at state universities.

Traci researched various graduate programs and decided to attend Notre Dame de Namur University. “I discovered that NDNU offered the most streamlined path to a credential,” she recalls. “When I started the program I felt, ‘This is where I belong.’ I was getting the right information at the right time in my life. At Notre Dame, I learned that each student has a unique story and you have to tap into those stories to reach them.”

She did her student teaching at Half Moon Bay High School on the California coast, near her home. “A biology teacher transferred out of the school right when I finished my credential, and I was lucky enough to land the job,” she says. “I love getting to know the students, watching them grow from freshmen to seniors. Just to have a little part in shaping their futures is a privilege.”

Traci was particularly gratified to help a high-achieving student in her AP Biology class who was having problems with anxiety and depression, falling behind in his classes. “He was able to open up to me and discuss his difficulties,” she recounts. “We’d chat after school and I worked with him to develop a timeline for finishing the missing assignments in all his classes. He said, ‘You‘re my person, Ms. Yerby.‘ With medicine and therapy, he was able to get back on track and earned high marks on his AP tests. I’m so proud of how far he has come, and he still visits with me.”

She tells her students about the range of ways that biology can be applied in careers. “There are medical uses for biology, of course, but now there are also ways to apply biology in engineering, informatics, law—I try to give them a sense of the opportunities.” Traci also hopes to serve as an example for girls who are interested in science. “As a female student, I didn’t have a lot of role models in science when I was in school. I tell all my students that they can be anything they want.”

Traci feels fortunate that she’s been able to make the transition to education. “Teaching is a great way to give back to the community,” she remarks. “Becoming a teacher is the best decision I ever made.”

For information on teaching credential programs at Notre Dame de Namur University, please visit our website.

Updated on March 6, 2019

“Where Do You Want to Be in Five Years?”: A Profile of Professor Judy Buller

Professor Judy Buller

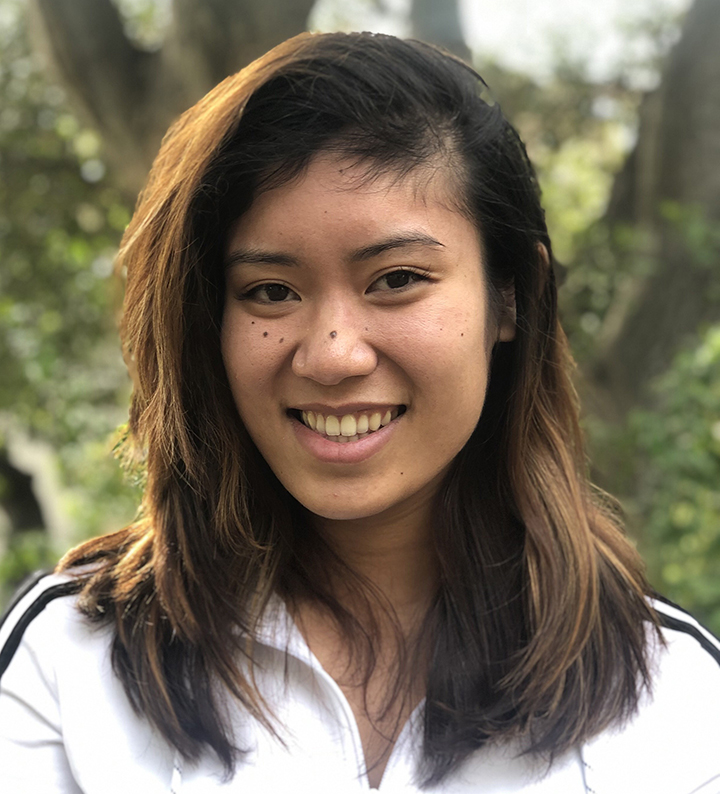

The first time I had Dr. Judy Buller as a professor was during my freshman year in Introduction to Communications at Notre Dame de Namur University (NDNU). As I took a seat, the first thing she said was, “Let’s take a moment and close our eyes and think of where we want to be in five years.” I was so confused, because I was barely making it through the day as it was. Four years later, and four classes with Dr. Buller later, the answer to her question feels so much more attainable than it was back then.

Dr. Buller herself also took a while to discover her career goals. Right out of college, she thought she wanted to work in broadcast news, and she did go into that field. As she entered her early 30s, she understood that she wanted to do something different than work in TV. She went back to school to earn her PhD in Journalism at the University of Texas, Austin. Teaching came soon afterwards, as she realized that she wanted a career that would benefit others.

Dr. Buller came across NDNU when she moved back to the Bay Area. She knew she wanted to steer away from auditorium-sized classrooms. She explains, “You don’t really have a connection with professors at traditional big colleges. I knew that I would want a connection with my students and my colleagues as a professor.” At NDNU, she makes sure that she knows every student in the Communication Department that she chairs. She checks in to see where their plans shift and progress during their years at our university.

Dr. Buller has many memories of her years at NDNU, but one of the most treasured ones was when she was given the George M. Keller Teaching Excellence Award in 2012. Students nominate a professor who motivates students, succeeds as an academic advisor, and has made an overall outstanding contribution to NDNU.

I can see why she received the award. I remember moments where Dr. Buller would come up to me and check up on how I was doing, including when I did not have any classes with her. Even before my senior year, she always reminded me that I needed to really think about what I want my career to be. She encouraged me to apply for internships before I was required to. Although it was stressful to apply for internships with no experience, I believe that her check-ins and motivation have given me higher confidence as I leave the university.

If there is anything that I have learned from Dr. Buller, it’s to aim as high as I can possibly go— apply for the job, travel to that country, or try out that new interest! Trying is better than not knowing. Everyone in college deserves a professor who helps them believe that they can achieve anything—Dr. Buller is that professor to me.

Jerileen Rae Ho, Notre Dame de Namur University Senior

Jerileen Rae Ho is a senior Communication major at Notre Dame de Namur University.

For more information on applying to Notre Dame de Namur University (NDNU), please visit the admissions page.

Updated on February 13, 2019

NDNU, My Home Away from Home

Sophia Apolinario, NDNU Undergraduate

I’ve been a tour guide for the Notre Dame de Namur University Office of Admissions for the past three years and one question I always get is “Why NDNU?”

Of the many reasons why I chose NDNU, I keep circling back to, “because NDNU is home.” Moving halfway across the world from Manila in the Philippines to the San Francisco Bay Area was no easy task. While homesickness still kicks in every now and then, I’ve come to realize (as cliché as it sounds), that home is not a place but a feeling. And that’s the feeling I get when I’m at NDNU. Here’s why:

NDNU’s Commitment to Diversity

I immediately felt like I belonged at this campus. Growing up with just Filipinos, it was refreshing coming to a school with such a varied student population. Even at freshman orientation, I immediately hit it off with a diverse group of friends and felt a deep connection with them. It’s not surprising to me that our campus was recently listed among the top 10 most diverse universities in the U.S. and that diversity is one of the university’s Hallmarks. The campus welcomed me, the Filipina “fresh off the boat,” with open arms, and I’ve met so many people from different backgrounds who have become my lifelong friends. I’m more aware of the world around me and have learned to celebrate different cultures. My friends took me to Dolores Park in San Francisco and to see the redwoods in Muir Woods. This broadened knowledge and curiosity about diversity is what pushed me to minor in sociology and become a Bonner Leader, where I helped homeless families find shelter and took part in vigils with loved ones of immigrants facing possible deportation.

Growth outside the Classroom

NDNU is committed to learning, and this doesn’t always mean in the classroom. Every year, we have Call to Action Day where students are encouraged to volunteer in various charities and communities around the San Francisco Peninsula—a way of living out our Hallmarks of community service. When I was a freshman I felt an urge to be more involved in social justice work and ended up at the Sister Dorothy Stang Center. They connected me with a local childcare center where I volunteered for almost two years. The resources needed for students to grow academically, professionally, and spiritually are easily accessible at NDNU.

Professors and Faculty

I’ve once been in a class with only eight students, and let me tell you, I was beyond nervous. Oh gosh, I can never miss a class or say the wrong thing, I thought. But as the semester went by I started to appreciate NDNU’s class size and student-teacher ratio. Why? Because the professors take the time to hear the students’ opinions. Our voices matter. For example, I was in a sociology class where we toured the Tenderloin neighborhood of San Francisco at night, an area where many homeless people live. My professor mentioned my written reflection in class because I had discussed the people we encountered, including homeless people we spoke to that night, and I had talked about their humanity and dignity.

Moreover, being in such a small school enabled me to know my classmates and professors on a personal level. At NDNU, you’re not just a face in a classroom of 100 people but a student who the professors know and want to see succeed. The school has given me a hands-on educational experience where I’m easily able to approach my professors when I feel like I’m not understanding the topics well enough. The professors not only care about your in-class performance, but your overall well-being. I’ll never forget the time my sociology professor came up to me after class and asked, “Are you okay, Sophia? I noticed that you seemed a little stressed. I’m always here if you need anything or someone to talk to.”

I never thought that nearly four years after arriving, NDNU would be the place I’d call my second home. In such a short span of time, I went from being completely homesick to completely in love with the community at NDNU, a place that I’ll really miss once this chapter of my life is over.

Sophia Apolinario is a senior Communication major at Notre Dame de Namur University who grew up in Manila in the Philippines. She plans to work in communications after graduation.

For more information on applying to Notre Dame de Namur University (NDNU), please visit the admissions page.

Updated on February 1, 2019

Wrestling with Pythagorus: How I Conquered Math Anxiety

Sophia Apolinario, Notre Dame de Namur University student

In high school, I was one of the top 15 students in my graduating class, but ironically, I was probably the worst at math. Going into college at Notre Dame de Namur University as a Communication major, I was really excited to finally kiss the subject goodbye.

With luck by my side, I passed the university’s math placement test and was required to take only one math class during my four years of study. The class was Math and Life, basically an accumulation of all the math you dreaded in high school.

I was thinking, Oh, no, back to trigonometry we go, with my anxiety skyrocketing. I knew that another C in math would affect my dream of graduating college summa cum laude. Yes, as a freshman I was already thinking of how one class could affect my chances of being an honor student!

I’d heard about the NDNU Student Success Center, where students are tutored on campus, but I’d never actually been there. I was on the way to the cafeteria one day when I stumbled across the center. That’s when I met the senior Computer Science major Tej who ended up becoming my math guardian angel. I made it a habit to utilize this free campus resource for tutoring every Tuesday and Thursday after math class.

More than Tej’s expertise in math, her teaching style helped me understand math in a way I never had before. Not only did she want me to ace the class, but she wanted me to grow and see the logic behind Pythagorus’ a2 + b2 = c2. I would have made my high school math teacher proud with what I learned from Tej.

We built not only a professional relationship but also a personal one, as she guided me through my first semester in college and gave me some tips. I was a commuter student and she helped me feel secure that I was not missing out by living at home my first few years. I even told two of my classmates about the Student Success Center, and they also started coming to Tej for math tutoring. The three of us who studied with Tej all became close friends.

By the end of my first semester, I was one of the top students in my math class, earning a high A. I remember running across my house yelling, “Mom!!! It’s literally a miracle!!!” and hugging her as if I had just won the lottery.

That is what I love about NDNU, how the professors and tutors not only want you to ace your classes but really see the deeper meaning behind the theories and lectures. They want to see you bloom and guide you every step of the way—both personally and professionally.

Sophia Apolinario is a senior Communication major at Notre Dame de Namur University who grew up in Manila in the Philippines. She plans to work in communications after graduation.

For more information on applying to Notre Dame de Namur University (NDNU), please visit the admissions page.

Updated on January 18, 2019

Thursdays with Jackie: A Profile of NDNU Professor Jacqueline Berger

Jacqueline “Jackie” Berger, professor of English, Notre Dame de Namur University

When it came time for me to sign up for a required Advanced Writing class at Notre Dame de Namur University (NDNU), I grabbed at the opportunity to take a class with Jacqueline (“Jackie”) Berger. I’d heard she was a poet with a reputation for being a great instructor.

Advanced Writing was the only English class I needed to complete my bachelor’s degree in Communications. However, I ended up taking five more English classes with Jackie. Consistently, Jackie encouraged me to achieve more in my writing and education, suggesting I add English as a minor and take her pedagogy course. Though I initially turned down both of her suggestions, little did I know Jackie was planting seeds. Roughly a year later, going into my senior year, I added English as a second major. Jackie is the kind of professor who sees the potential of her students before they do.

I attribute much of my success at NDNU to the professors I had. Jackie specifically had a huge impact on my life. Her feedback was always honest. I know a lot of students just look at the grade when a professor returns their work, but with Jackie, I always was eager to read all her comments. I’ve saved every paper I wrote that she commented on. She’d often play devil’s advocate and challenge us to think outside our preconceptions. Not only did she help me to become a better writer—and thinker—but she supported all of my activities outside of the classroom, attending every play I acted in or directed on campus, even at night.

Jackie is a phenomenal educator, and she is an inspiring human being. It seems as though Jackie was destined to be an educator, since she comes from a family of teachers. Her mother and brother are both teachers, and her father took early retirement from his career as an engineer to become a teacher. Perhaps the passion for knowledge is in her blood, although it wasn’t until she was a student at a small liberal arts college in Vermont that Jackie discovered she wanted to be a writer, and ultimately an educator. There she worked with two amazing poets who had an immense impact on her. Their class met at the top of a silo and Jackie remembers snow outside, drums beating, and free writing. “That was it,” Jackie says, “I got in touch with an aspect of my thinking that I never knew was there. I had no idea I could enter an altered state and do this kind of writing. Like dreaming.”

In addition to her career as a professor, Jackie is an award-winning poet with four published poetry books. Her most recent book, The Day You Miss Your Exit, was published in 2018. Jackie has also taught creative writing in women’s prisons.

One thing that has always left me in awe about Jackie is her willingness to learn from her students. When I asked her what the most important thing is that she has gathered from teaching, Jackie replied, “To observe how many different ways people learn and absorb information. I see students blossoming in their own way—there is no one path and that’s an exciting thing.” I’ve seen Jackie’s enthusiasm firsthand when she learns something new from one of her students. Jackie continued, “We are all infinitely complex. You can’t make an assumption about someone. People surprise you. I love that.”

Andrea Rosewicz graduated summa cum laude from Notre Dame de Namur University in 2018 with a bachelor’s degree.

For more information on applying to Notre Dame de Namur University (NDNU), please visit the admissions page.