Updated on November 14, 2018

Discovering My Calling as a Psychotherapist

MaryBeth Lorence, MS in Clinical Psychology, NDNU

It took me forty years to figure out what I want to be when I grow up.

Despite having spent many years in several jobs, I never thought I was someone who would have a Career with a capital “C.” With my undergraduate Communications/English degree, I tumbled into the graphic design and publishing world, largely because I liked to read. At some point, though, I lost interest in the release of the latest version of Photoshop.

For a while I pursued things I loved. I loved to cook, so I taught cooking classes. I worked out a lot, so I became a personal fitness trainer. I loved to write fiction, so I wrote fiction. I enjoyed all that, but none of it for me was sustainable. Something nagged at me, telling me there was something else I was supposed to do.

At the age of 40, I took a hard assessment of my life. I reviewed all I had done to try to find out what sparked me. As a cooking instructor, I empowered people to take risks. As a fitness instructor, I worked one-on-one with clients in their homes, finding out what motivated them to change, and listening to some very personal stories. And as a writer, I analyzed how the past shapes a person. In other words, I explored psyches.

I decided to give psychology a try. I was nervous when I first sat down in my Psych 101 prerequisite class. I was afraid that—like many other things I’d attempted—I might lose interest. But three hours later, I walked out of that class feeling for the first time in my life that I had a direction, that I had a purpose, that I had—surprise, surprise!—a Career.

My time as a grad student at Notre Dame de Namur University solidified my commitment to becoming a therapist. It was at NDNU that my purpose turned into my passion, particularly during what was then a year-long psychopathology class taught through a psychodynamic/psychoanalytic lens. I know psychoanalytic psychotherapy isn’t for everyone, but it aligns with how my mind works. It was extraordinarily helpful to me that my practicum class also used that lens. I was challenged in the best way, and I was able to learn from other newbies as we took deep dives into our cases.

As someone who is math-challenged, I was awash with relief when my graduating class became the first to have the choice of a capstone project or a thesis. I chose capstone: no statistics! But I didn’t slack. I wrote a 100+ page review of the research in my field to develop a new treatment for complicated grief. I submerged myself in this and emerged sometime in the final semester of my program, blinking in the light. My thesis advisor, with his encouragement and humor, made sure that I did emerge, and that I produced a project that I can be proud of.

I’m nearing the end of my status as an Associate MFT (I’ve recently completed my 3000 required hours of training!). Some associates stay at the same agency or position for their entire pre-licensed tenure. There are many advantages to that—stability, developing deep working relationships, perhaps the ability to see clients long-term. Maybe it’s just my nature to jump from one experience to another. I changed internships each year.

As a trainee, I counseled kids at a K–8 school, and I also worked at Mission Hospice doing grief therapy. The grief work introduced me to clients with anxiety, depression, substance issues, relational problems, trauma, and personality disorders. Working with those clients gave me the confidence to apply the following year for a position at the Women’s Enrichment Center, an intensive outpatient program, working with women with multiple diagnoses who’d suffered (most of them) from several traumas. It was intense, tiring, frustrating, and one of the most rewarding experiences I’ve had as a therapist.

The following year (last year), I took a position at the counseling center at the College of San Mateo (CSM), where I continue to work. CSM provides as close to a private-practice model as you can get without actually being in private practice. I have my own office, I set my own hours, my clients vary in age from 18 to 58, range in presenting issues from “I just broke up with my girlfriend” to complex trauma, severe depression, suicidality, social anxiety, life transitions—really, almost anything.

In July of 2018, I also began working in an actual private practice, which has been a wonderful learning experience that will help me launch myself once I pass my clinical exam (oh, yes, I will!) and hang my shingle. Having worked with underserved communities, I also want to continue to provide treatment to those who may not be able to afford typical therapy rates. In addition, I hope to be able to teach psychology classes, both because I love to teach and because I want to be witness to that potential student who, like myself, walks out of Psych 101 having finally found his or her passion.

MaryBeth Lorence graduated from the Master’s in Clinical Psychology program at Notre Dame de Namur University in 2016. She currently works at a counseling center and has a private practice. She is also a participant in the 2018–19 fellowship program at the Palo Alto Psychoanalytic Psychotherapy Training Program (PAPPTP).

For more information on Notre Dame de Namur University’s Clinical Psychology program, please visit the website.

Updated on October 24, 2018

Science Stars or Scientific Illiterates: The Choice Is Ours!

The following is an article by Melissa Book McAlexander, Ph.D. and Isabelle G. Haithcox, Ph.D. that will appear in the premiere issue of NDNU Today, the magazine of Notre Dame de Namur University. The entire magazine will be available online Wednesday, October 10, 2012, at ndnu.edu/magazine.

NDNU is about to embark on one of the most exciting endeavors in its history. Thanks to over $6 million in grants from the federal government that we were eligible to receive as a Hispanic-Serving Institution (HSI), NDNU is instituting exciting new programs to help Hispanic and low-income students succeed in college. Some of the grant funds are earmarked especially to help more Hispanic and low-income students pursue careers in what are called STEM (science, technology, engineering and mathematics) professions. Yet for all our good intentions, programs like ours will fail miserably if we don’t take science education at the high and middle school level more seriously.

Case in point: California, a state known for its progressive environmental policies and leading-edge technology, ironically stood on the cusp of setting science education back by decades during the state budget negotiations earlier this year. At a time when the rest of the world is becoming increasingly competitive in science and technology, a little-known provision of Gov. Jerry Brown’s proposed 2013-14 budget would have eliminated the requirement that high school students take two years of laboratory science and instead require one.

Thankfully, the approved budget salvaged the funding for a second year of science, although Gov. Brown promises massive cuts to education in November if voters don’t approve a tax increase. But the fact that California’s leadership, overseeing the ninth largest economy in the world, so devalues science education that it’s willing to risk producing a generation of science illiterates is alarming. Our focus needs to be on better preparing our students. As it is, students in California and across the country all too frequently arrive in high school with limited science experience from elementary or middle school. The intense focus on testing in math and reading in early grades, increasing class sizes, and ever-smaller budgets leaves little room for serious science education. Even two years of mandatory laboratory science in high school can’t completely close that gap. The effect of these years of limited experience in science is that many students arrive in college uninterested in science and at a disadvantage in developing critical thinking skills. One of my colleagues, who has taught middle and high school science, says science is critical for “figuring stuff out.” Science experiences help students gain the skills they need to solve challenges and make decisions in all areas of their lives, not just in chemistry. Additionally, students who may be interested in science degrees often lack proper foundations for scientific observation or measurement when they begin college-level work.

Thankfully, the approved budget salvaged the funding for a second year of science, although Gov. Brown promises massive cuts to education in November if voters don’t approve a tax increase. But the fact that California’s leadership, overseeing the ninth largest economy in the world, so devalues science education that it’s willing to risk producing a generation of science illiterates is alarming. Our focus needs to be on better preparing our students. As it is, students in California and across the country all too frequently arrive in high school with limited science experience from elementary or middle school. The intense focus on testing in math and reading in early grades, increasing class sizes, and ever-smaller budgets leaves little room for serious science education. Even two years of mandatory laboratory science in high school can’t completely close that gap. The effect of these years of limited experience in science is that many students arrive in college uninterested in science and at a disadvantage in developing critical thinking skills. One of my colleagues, who has taught middle and high school science, says science is critical for “figuring stuff out.” Science experiences help students gain the skills they need to solve challenges and make decisions in all areas of their lives, not just in chemistry. Additionally, students who may be interested in science degrees often lack proper foundations for scientific observation or measurement when they begin college-level work.

Meanwhile, colleges and universities struggle to fill gaping holes in STEM education. How can students from low-performing and under-funded schools eventually pursue the high-paying jobs available in STEM fields, when they arrive at college ill-prepared for even the introductory coursework in these majors? To adequately support these students, we’ll need more tutoring and academic support; otherwise, these students are at risk of earning low grades or changing majors before they’ve gotten through the gateway courses.

Why does all of this matter? Well, for one thing, the federal government has been emphasizing the importance of strengthening science, technology, engineering and math education to keep the U.S. workforce competitive in a global economy. President Obama has called for training 100,000 new STEM teachers by 2020 and generating a million new STEM graduates in order to keep the United States’ edge as a leading technological innovator. The country needs graduates proficient in STEM fields to fill jobs in fields ranging from computer science to environmental engineering to renewable energy. We also need knowledgeable teachers at all levels, from kindergarten to university, to prepare

our students to pursue these careers.

High school science classes are vital for exposing students to STEM fields; for some, it will be the last science instruction they ever have, and for others it will lay the groundwork for a college major and perhaps a science-related career. Either way, we’ll only harm ourselves by failing to provide comprehensive science education in high school. By generating high school graduates uninterested and ill prepared for STEM majors and careers, we’ll be creating a knowledge deficit from which we might never rebound.

While programs like those now offered at NDNU are invaluable, they’re no substitute for good educational policy and investment in science education. St. Julie Billiart, co-foundress of the Sisters of Notre Dame said, “Teach them what they need to know for life.” In providing support for students pursuing STEM fields at NDNU, we are doing just that.

Updated on October 24, 2018

Giving Tuesday Is A Way Of Life

A number of charities and businesses across the country have named today “Giving Tuesday,” so perhaps it is fitting that today representatives of NDNU’s Mail Center delivered more than 20 boxes of warm weather clothing to InnVision/Shelter Network. However, community engagement isn’t a one-day process; at NDNU, it’s a way of life.

Even though David Baird doesn’t work in the classroom, he still found a way to incorporate the social justice mission of the university into his work and teach those values to our students. Baird, who runs the university’s Mail Center, organized a coat drive for the second consecutive year not only to help those who needed clothing to keep warm in the winter, but also to demonstrate to his student workers the importance of helping those who are in need. “I like involving the students so we can give them a taste of what community engagement is like, and show them that it doesn’t take much effort to help lots of people,” said Baird. The students who assisted Baird with the coat drive are Alex Aguilar, Sal Arias, Gerardo Rodriguez, Marisela Torres, Cristina Basulto and Jordan Tupfer Cruz. “Marisela went with me to deliver the coats,” said Baird, “and we talked about how the little that we did makes a big difference. She could appreciate that.”

Even though David Baird doesn’t work in the classroom, he still found a way to incorporate the social justice mission of the university into his work and teach those values to our students. Baird, who runs the university’s Mail Center, organized a coat drive for the second consecutive year not only to help those who needed clothing to keep warm in the winter, but also to demonstrate to his student workers the importance of helping those who are in need. “I like involving the students so we can give them a taste of what community engagement is like, and show them that it doesn’t take much effort to help lots of people,” said Baird. The students who assisted Baird with the coat drive are Alex Aguilar, Sal Arias, Gerardo Rodriguez, Marisela Torres, Cristina Basulto and Jordan Tupfer Cruz. “Marisela went with me to deliver the coats,” said Baird, “and we talked about how the little that we did makes a big difference. She could appreciate that.”

From October 15 to November 21, the Mail Center collected donations of coats, rain jackets, boots, scarves, hats, sweaters and umbrellas from students, staff and faculty. Anyone wishing to make a donation simply had to notify the Mail Center and someone would come to pick the items up. “I am so thankful for our campus community’s effort in this coat drive,” said Baird. “It is heartwarming to know that everyone cares enough to help our neighbors in need.”

Top photo: David Baird with students Marisela Torres and Jordan Tupfer Cruz before delivering donations to InnVision/Shelter Network.

Updated on October 24, 2018

Pay for College With Scholarships

As someone who went back to college later in life, and as a parent who paid for the first child’s private education, and has another one currently in college, I understand the benefits of seeking out scholarship opportunities. It would have been a tremendous help to know that we were most likely eligible for something, even if it was small.

As someone who went back to college later in life, and as a parent who paid for the first child’s private education, and has another one currently in college, I understand the benefits of seeking out scholarship opportunities. It would have been a tremendous help to know that we were most likely eligible for something, even if it was small.

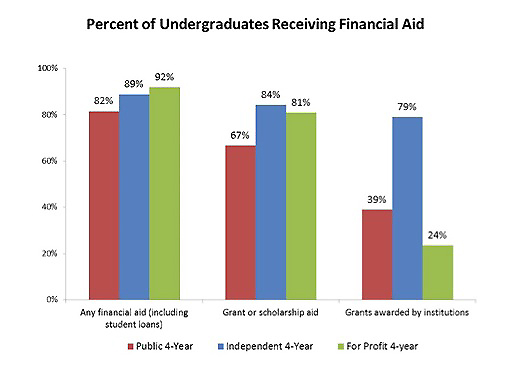

Once I started to work in education, I was shocked to learn how much money goes un-awarded because people just don’t apply. I also discovered that grant and scholarship aid for full-time students continues to increase. According to College Board, 53% of college tuition is paid for through scholarships and grants, but there is still a lot of money that goes un-awarded due to lack of applicants.

Here are some useful tips that I found while searching for scholarships.

- Do not pay a fee for scholarship searches. If you work independently you can generally find more sources than using a paid service.

- Resources like high school and college guidance counselors, web searches, information from the Department of Education and other sources are available to help you organize your search.

- As you search you may notice that often grant or scholarship searches are focused on targeted groups like academics, talent, athletics, diversity, underrepresented groups (example: first generation students) and geographical locations. If you string together words like scholarships, grants, college, university, adult, graduate student, major of interest, your ethnicity or groups you are involved with, this can also bring up random scholarships that are available.

- Graduate, credential and adult (non-traditional) students should also do these searches. There are generally less funds available for these groups, but it can be worth the effort.

- In exchange for use of a web site you might be asked to provide your email. People often create a secondary email from a free service if they are asked to provide their information, especially if they are concerned about the free search sites searching them out as well. That way you also have all of the sites and responses in one place.

- Listed outside scholarships are additional to what a specific college might offer and do not include other grants or scholarships that a school’s financial aid office can determine your eligibility. Always remember to check with them as well.

- Search local, you’d be surprised how many local scholarships are available, especially in the San Francisco Bay Area and Silicon Valley.

With the internet the search process has become much easier. There are many sites available to search from. In our free download, “Outside Scholarship Search Information For College Students,” we’ve included links to most of the key sites, as well as sites for diverse groups. Download it today and get started on your scholarship search!

Updated on October 24, 2018

Public or Private College? Getting the best return on your investment.

As parents and students look at the rising costs of higher education, many have debated whether attending a private university in California is worth the expense. Here are some factors to consider:

Fact or Fiction?

Public Universities + Grants + Loans = Affordable Opportunities

Community colleges are seen as opportunities for immediate career placement, story or cost-saving measures for students with ambitions to transfer to a four-year institution. The total average cost of completing an AA degree in two years at a California community college was estimated to be $5,000. Students see this as an affordable opportunity to achieve a meaningful income.

For undergraduates considering the CSU or UC system, there is a wide-spread belief that they save on cost in the long-run versus a private education. Publicized access to grants and loans coupled with projected overall cost of attendance by the CSU and UC systems creates this expectation.

What are the financial risks of enrolling in a public institution?

Public colleges and universities are frequently targets for state cost cutting. California has seen a $1.5 billion cut to higher education between 2007-2008 and 2011-2012.

These cuts are significant and:

- Impact ability to offer merit scholarships to students

- Increase tuition rates on students, both in-state and out-of-state

- Reduce the size of faculty

- Create a shortage of class offerings year-round

- Generate large class sizes

- Result in longer delays to graduation

Students in public institutions are acquiring more risk and debt than anticipated.

Theoretically, students attending a community college should be able to complete their degree or transfer in as little as two to three years.

According to EdSource.org, only 52% of students in the California community college system seeking a degree, certificate or transfer, succeed after SIX years (spending an additional average $15,000 or more).

Some reports show completion rates taking as long as EIGHT years.

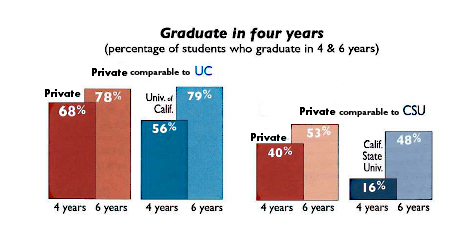

The National Center for Education Statistics shows an average matriculation rate for students starting at a four-year public institution is 72 months (six years) from first year of enrollment.

Aside from delays in graduation, students must work harder to be their own skilled advocate and find the external support they need to attain their degree goals. This includes ongoing access to information and advising on financial aid procedures and career mentoring. Transfer students also must keep up with changing admission standards for four-year colleges to acquire the necessary prerequisites to transfer (i.e. specific class units or an AA degree). This can sometimes be the biggest challenge. Many transfer students find that not all their coursework credits from their community college are equal to the coursework credits of the four-year public school counterpart. Private colleges have more flexibility on transferable coursework than the UC’s or CSU’s do.

Fact or Fiction?

Private Universities + Grants + Loans = Costly Opportunities

VIDEO: 9 Myths about Private Nonprofit Higher Education

Publicized access to grants and loans coupled with projected overall cost of attendance at private universities often creates “sticker shock”. Although the initial shock gives the impression private education is too costly, it may be the more affordable option.

Oftentimes the published rates are rarely what students end up paying. According to the Council of Independent Colleges:

“Independent colleges and universities give students more than six times as much grant aid as does the federal government”.

Private universities are constantly working to find the best incentives for their students. They want to create lasting relationships. Whether you are a first-generation student, a top achiever or a high-need student, private universities invest time and resources to get to know you and to ensure that hard work outside the classroom is equally acknowledged when awarding scholarships.

The key to getting the most for your money is to inquire with the private universities about scholarships, grants and discounts available to you. Search outside scholarships.

The key to getting the most for your money is to inquire with the private universities about scholarships, grants and discounts available to you. Search outside scholarships.

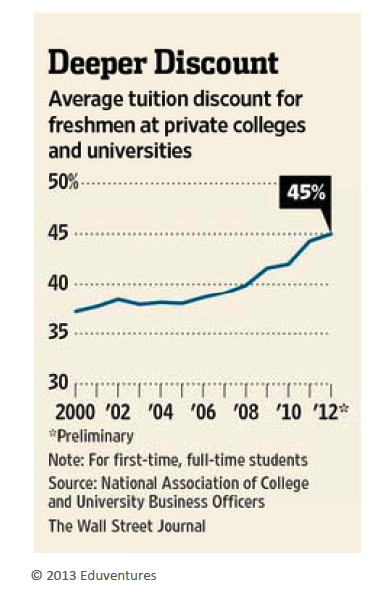

Most private universities have the flexibility of offering an average tuition discount rate of 45% (sometimes more) to help offset the cost of your private education.

As a result, nearly one-third of bachelor’s students were able to graduate without any educational debt in 2012.

At the graduate level, the average student loan debt accrued is $22,380 – about $4,000 less than the national student debt level quoted by the Obama administration.

What are the risks with enrolling in a private institution?

Private universities may at times change their discount rates for various reasons, they do not however, run into the same issues that public institutions often face with state cost-cutting measures. Be sure to inquire with the Financial Aid Office for opportunities available to you.

Fewer years of paying tuition often means a quicker start at earning a salary.

According to the National Center for Education Statistics, the average graduation time for students in private universities is 50 months (4.2 years) from start to finish.

When calculating the true cost of college, it is important to consider the opportunity cost of delayed income in addition to the potential expense of an extra semester or year.

How private universities benefit the student:

- Getting into classes = finishing sooner

- Relevant majors + internships = great jobs

- Small class sizes = personal attention

- Guaranteed one-on-one advising = quality education

Consider if you graduated in four years instead of six, you could potentially be making $40,000/year, times two years, and be $80,000 ahead!

Note to Transfer Students:

Private universities each have their own transfer crediting methods. Some universities don’t require an AA degree completion to start classes, others may not allow you to retain all the credits earned at the community college level.

Check with an admissions counselor to ensure your classes are transferable. Click below to set up an appointment.

Updated on October 24, 2018

Accounting is hip and sexy these days!

Want a career where people are interested in what you have to say and offer? How about a job that is in demand while making good money? Do you want the flexibility to be self employed, work for a government organization or a large corporation?

Want a career where people are interested in what you have to say and offer? How about a job that is in demand while making good money? Do you want the flexibility to be self employed, work for a government organization or a large corporation?

Accounting is more than just crunching numbers these days and can actually be an interesting and lucrative career. Here are five popular career paths for accountants:

- International Accountant: Accounting isn’t all about office work. International accountants get to travel to faraway places and work with people all over the globe.

- Forensic Accountant: Forensic accountants go wherever the money takes them, investigating financial crimes and insurance fraud on behalf of companies and public law enforcement agencies.

- IRS Criminal Investigation Special Agent: Embezzlement, extortion and even murder are just a few of the crimes that IRS criminal investigation special agents uncover as a result of their scrutiny, according to the agency’s website.

- Comptrollers: Sometimes called controllers, they are in charge of an organization’s or governments purse strings, and closely watch all outgoing and incoming finances. Chief accountant is another way to describe the position. It’s a big responsibility to have, not to mention a pretty cool one as well.

- Chief Financial Officer: Forget about CEOs. As far as Wall Street is concerned, CFOs are the real kings of corporate America. CFOs are responsible for a company’s financial goals and budgets. In a publicly traded company, they are accountable for the organization’s financial reporting. The possibilities are endless!

Make sure you check out the Bachelor of Science in Accounting at Notre Dame de Namur University to help provide you with a strong foundation in business, highly valued by business employers. A major in accounting will allow you to meet the necessary academic requirements needed to take the professional Certified Public Accounting (CPA) examination.

Updated on October 24, 2018

Nonprofits are big business. Qualified leaders are in high demand!

There has been a lot of discussion and research lately about the demand for organizational workers and leaders in the nonprofit sector. But, did you know that the nonprofit sector also grew faster — in terms of employees and wages — than both business and government combined?

There has been a lot of discussion and research lately about the demand for organizational workers and leaders in the nonprofit sector. But, did you know that the nonprofit sector also grew faster — in terms of employees and wages — than both business and government combined?

Approximately 2.3 million nonprofit organizations currently operate in the United States, representing the third largest workforce of U.S. industry. In 2012 alone, public charities reported over $1.65 trillion in total revenues and $1.57 trillion in total expenses, accounting for 5.5% of the nation’s total GDP.

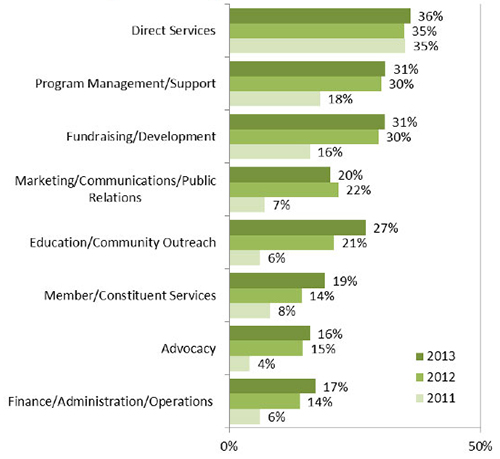

Figure 5: Anticipated Job Growth in Specific Areas by Year

Approximately one-third of nonprofits surveyed anticipate growth in the area of direct services (36%), program management/support (31%), and fundraising/development (31%) in 2013. As seen in figure 5, the percentage of organizations anticipating job growth increased from a year ago – and dramatically from two years ago – in all areas, with one exception, marketing/ communications/ public relations. Source: http://www.nonprofithr.com/wp-content/uploads/2013/03/2013-Employment-Trends-Survey-Report.pdf

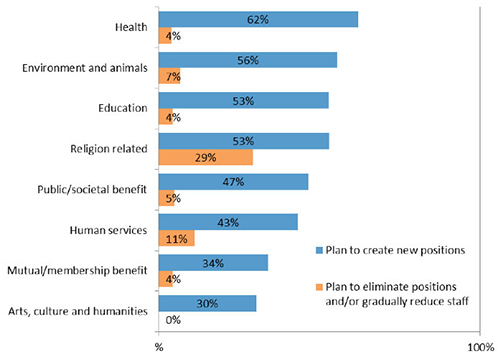

Figure 2: Plans to Create New Positions and Eliminate Positions and/or Gradually Reduce Staff in 2013 by Organization Type

This graph illustrates which fields anticipate the greatest increase in positions. Over half of health (62%), environment and animals (56%), education (53%), and faith-based (53%) organizations surveyed indicated that they plan to create new positions this year. In their projections to 2020, the Bureau of Labor Statistics findings support the increase in health care positions; they predict that employment in the health care and social assistance sectors will generate the largest number of jobs at an annual rate of 3%, which is the largest rate of all major employment sectors. Source: http://www.nonprofithr.com/wp-content/uploads/2013/03/2013-Employment-Trends-Survey-Report.pdf

Exceptional leaders are in demand in the nonprofit sector.

According to Nonprofit HR Solutions, clients respond to the significant economic changes of the recent three to four years by maximizing efficiencies in infrastructure and operations and putting an even greater focus on the direct services work that influences resource development strategies. In this regard, all areas of nonprofit business that resonate with funders have greater opportunity to be highlighted and funded for further growth. That said, continued organizational growth and mission advancement requires a proportionate response in terms of infrastructure and operational support.

Job outlook by role.

According to the U.S. Bureau of Labor Statistics, many of the roles Master’s of Public Administration (MPA) graduates pursue will see double-digit growth in employment between 2010 and 2020.

- Human Resources Manager – 14%

- Social Scientists and Related Workers – 18%

- Urban and Regional Planners – 16%

- Social and Community Service Managers – 27%

- Medical and Health Services Manager – 22%

- Public Relations Managers and Specialists – 21%

- Management Analysts – 22%

- Business and Financial Operations – 17%

- Training and Development Managers – 15%

- Operations Research Analysts – 15%

Learn how a Masters in Public Administration gets you the job.

According to the nonprofits that participated in the survey conducted by the Nonprofit Finance Fund, highly-trained organizational leaders are needed, now more than ever, in order to meet the growing demand for services and implement a wide range of goals: most importantly long-term financial sustainability.

This broad, yet flexible degree, allows you to instantly pursue many promising and well-paying job opportunities in a number of high demand and growth fields.

Fortunately there are programs to choose from to obtain an MPA, either with and online or an onground program through Notre Dame de Namur University (NDNU). A Master of Public Administration (MPA) degree from (NDNU) can help advance your career by preparing you for a wide variety of job opportunities across multiple industries, including government and private sectors.

Founded in 1851 by the Sisters of Notre Dame (originally from Namur, Belgium), Notre Dame de Namur University (NDNU) is an accredited Catholic, not-for-profit university in the San Francisco Bay Area in Silicon Valley. The University offers a welcoming, accessible learning environment anchored by dedicated professors who are committed to guide students both in their academic pursuits and career development.

Updated on October 24, 2018

Opening Doors: Women in Science

“If we’re going to out-innovate and out-educate the rest of the world, we’ve got to open doors for everyone. We need all hands on deck, and that means clearing hurdles for women and girls as they navigate careers in science, technology, engineering, and math.”

College degrees and jobs in science, technology, engineering and math (STEM) are all the rage right now. The jobs aren’t just exciting; they’re growing as well:

College degrees and jobs in science, technology, engineering and math (STEM) are all the rage right now. The jobs aren’t just exciting; they’re growing as well:

- STEM grads have a lower unemployment rate than non-STEM grads (see She Geeks infographic)

- The growth in STEM jobs in the past 10 years was three times greater than that of non-STEM jobs (see Edutopia infographic)

- And that growth isn’t stopping: STEM jobs are projected to grow 17 percent from 2008-2018; non-STEM jobs are only projected to grow 9.8 percent

- The payoff for STEM jobs is greater: STEM majors who go on to work in STEM jobs earn 20 percent more than non-STEM majors in non-STEM jobs (read report)

But another hot topic is gender inequality in the workplace, and the story is no different in STEM fields. According to the U.S. Department of Commerce, while women make up almost half of the workforce in the United States, they have less than 25 percent of STEM jobs, despite the fact that more college-educated women have joined the workforce. However, women with STEM jobs earn 33 percent more than women in non-STEM jobs, and gap between compensation for men and women in STEM fields is less than in other areas.

With all the potential that is available to women in STEM, why aren’t there as many women pursuing STEM careers? In “Women in STEM: A Gender Gap To Innovation,” gender stereotyping and a lack of female role models are cited as a couple of the reasons for the discrepancy.

At Notre Dame de Namur University, there’s no shortage of female role models within our Department of Natural Sciences. We caught up with Natural Sciences faculty Melissa McAlexander, Ph.D., and Rachel Shellabarger, MS, to get their perspective on women in science.

Why did you pursue science?

MM: I was the kid who always loved science – it seemed like fun. My high school biology teacher had a particularly strong influence on me. She really encouraged me, and probably helped me understand for the first time that I could pursue science as a career.

RS: I think the case for myself and a lot of my colleagues was that we found topics we liked and stuck with them because we were passionate about them. As a more general trend, however, I think the scientific process is a way of thinking that works in all realms of life, and perhaps those of us that end up in scientific fields really appreciate that process.

Why is it important for women to work in science?

RS: It’s important for people to go into fields they are interested in and passionate about, regardless of their background/demographic. Science thrives on a range of diverse opinions, and we want the scientific field to be representative of our population as a whole. As with many other fields, there has been a history of excluding women (and other groups) from various parts of science, so we of course want to move toward a future where no group is excluded from a field because of demographics.

MM: In any field, having women as part of the team increases the diversity of ideas and experiences at the table. The process of science benefits when different perspectives are represented in the approaches we take. No gender or ethnicity (or any other way of classifying people) does science “better” than another. But the more we engage the whole of the population in science, the better science gets.

What advice would you give to a student who wants to pursue science?

RS: A career in science requires lots of hard work to understand course material, research protocols/findings, and the broader impact of science on society. Every individual’s background prepares them for scientific inquiry in different ways, and it’s important to understand the skills you bring with you, as well as the skills you need to work to improve.

MM: Go for it, if it is a fit with your interests, skills, and passion. You need to love the process of doing science, of gaining new understandings about the world, and/or of making something beneficial to society. There’s loads of fascinating questions being asked in laboratories in all fields these days – find an area you’re passionate for learning about, and dive in deep. Be ready to be challenged – to try something no one has ever done before, to learn new techniques, and to repeat something challenging until you perfect it.

Science: Where Can You Go and How Do You Get There?

When it comes to science-related job opportunities, the sky’s the limit. There are a number of jobs in clinical or research laboratories that do not necessarily require graduate degrees. Scientists in these positions are trying to answer many different questions that can have a direct impact on our lives. But not all scientists work in the lab — many companies are looking for knowledgeable employees to help with product development or provide technical customer service. These opportunities are available in a variety of fields, including molecular biology, biochemistry, health care and environmental science.

You may find working in science education may be more your speed. From university professor to grade school teacher to after-school science programs and museum education programs, there are many ways you can help pass on knowledge to the next generation of inquiring minds. Melissa McAlexander worked at The Tech Museum of Innovation in San Jose before coming to Notre Dame de Namur University. “It was a fabulous way of thinking about how to engage the public with science,” says McAlexander. “And man, was it fun!”

There are a number of scholarships available for women interested in studying science in college; here are a couple of web resources to get you started on your search:

Notre Dame de Namur University offers undergraduate degrees within the natural sciences — biochemistry, biology and kinesiology — as well as minors in biology, biochemistry, chemistry and environmental justice. A Bachelor of Science from NDNU will prepare you for the many exciting opportunities in science.

Updated on October 24, 2018

Human Services: It’s not just about social work anymore.

There is a growing need for people in a variety of helping professions.

Individuals who recognize the importance of working with people, visit this serving them and meeting their needs are often drawn to human services to enhance their abilities to help others, take management roles in organizations or even start their own nonprofit. Although many jobs are in the nonprofit sector, generic often in well-paid positions, employee and human services positions in private and government organizations are also in demand.

Individuals who recognize the importance of working with people, visit this serving them and meeting their needs are often drawn to human services to enhance their abilities to help others, take management roles in organizations or even start their own nonprofit. Although many jobs are in the nonprofit sector, generic often in well-paid positions, employee and human services positions in private and government organizations are also in demand.

Did you know that social and human services are among the most rapidly growing occupations?

According to the Bureau of Labor Statistics, job opportunities for social and human service employees are expected to grow much faster than average for all occupations, particularly for applicants with appropriate postsecondary education. The number of social and human service assistants is projected to grow by nearly 23% for all occupations between 2008 and 2018. Approximately 80,000 new jobs are expected to be created during the next decade. Many additional job opportunities will arise from the need to replace workers who advance into new positions, retire, or leave the workforce for other reasons. Employment in private agencies will grow as state and local governments continue to contract out services to the private sector in an effort to cut costs. Demand for social services will expand with the growing elderly population, who are more likely to need these services.

What can I do with a Human Services Degree?

The leadership skills developed makes Human Services graduates valuable contributors in non-profit organizations, government agencies, and corporations.

Examples include careers in:

- counseling and social work

- human resources or employee relations (profit and nonprofit)

- health care

- gerontology

- community advocacy

- law enforcement and other public safety fields

- employee relations

These jobs include working with:

- children and families

- the elderly

- people with disabilities

- people with addictions

- veterans

- people with mental illnesses

- immigrants

- homeless and displaced people

What does a Human Services degree offer?

As one of the more versatile degrees, a Bachelor of Science in Human Services prepares you for work in a variety of fields and settings depending on your interests. Prerequisites for this degree generally require introductory knowledge of psychology and sociology.

Students often learn to develop skills in communication, advanced professional writing and how to apply and demonstrate problem-solving techniques to areas in Financial Management, Social Responsibility and Ethics. At Notre Dame de Namur University, students often enhance their career goals by focusing on one of three specialized areas:

- Administration

- Counseling

- Gerontology

A Bachelor’s of Science in Human Services can be a stepping-stone to a post graduate degree for professionals to advance their careers in management; many students continue their studies with a master’s in public administration, business administration, social services or psychology.

“Being in this program has truly changed my life as an individual, as a student, and as an employee. It has helped me gain better understanding of others in a realistic way and has inspired me even more to help and make a difference. The support of the advisers and teachers within the program makes an extreme difference. It is not easy to come back to school, but they are very supportive. They aren’t just there assisting in class, but are available to help at your convenience and sometimes where it is convenient for you. I can’t think of anywhere else in my education where I have had that much support and encouragement.” Read more student feedback.

Learn more about our accelerated evening Bachelor’s of Science in Human Services.

Updated on October 24, 2018

Demand for Teachers is Increasing in California

If you want a career in teaching, now is the time!

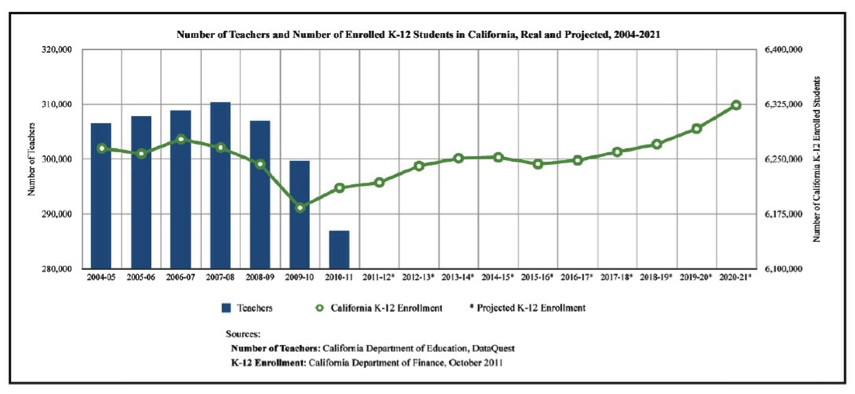

The State of California is currently experiencing a teacher shortage in a variety of areas. With many teachers currently retiring or nearing retirement age, doctor the state needs 20, troche 000 new teachers a year. At the same time, the number of new teaching credentials granted annually in California is roughly 11,500, leading to a critical shortage and many opportunities. (Read more)

Teaching jobs are becoming available again

A recent report from the Learning Policy Institute showed that 75% of California school districts surveyed were experiencing teacher shortages. The vast majority of these districts reported that their shortfall was growing.

What subject areas are in highest demand?

In addition to the number of teachers needed, many school districts have a particularly strong demand for qualified teachers in mathematics, science, bilingual education and special education.

How do I get started?

Only a few universities in California now offer blended programs for undergraduates to complete a bachelor’s and a credential in as little as four years. Notre Dame de Namur University (NDNU) is one of the few colleges in California with this option, with a strong reputation for excellence in teacher education programs.

If you already have a bachelor’s degree and are interested in a credential, you can start a program as early as May 2017 to complete by fall 2018.

If you are just getting started, an accelerated blended Liberal Studies program offered through NDNU is designed for students to finish a BA and credential in as little as four years. Providing early fieldwork experiences in education, the program’s structured advising allows for successful job placement by graduation.

That saves an additional year or two of classes and gives first-year students an opportunity to gain fieldwork experience right away.

New single-subject credential program in biological sciences

NDNU is about to roll out a new four-year program that leads to a bachelor’s degree and a single-subject teaching credential for biology. The program, offered in conjunction with the San Mateo County Community College District, prepares students for classroom teaching in middle schools or high schools with four years of study. Students can complete the first two years of the curriculum either at NDNU or at a community college, allowing for significant time and cost savings over many other teaching credential programs. NDNU will begin accepting applications for the program in fall 2017, for fall 2018 admission.

Financial aid opportunities

There are special grants and financial aid available for students going into teaching. NDNU admissions and financial aid counselors can help you identify and apply for these funding opportunities.

Teaching as a second career

Many professionals are finding that after a career in business, the military or other sectors, they are looking for a work path that allows them to pass on knowledge and opportunities to the next generation. NDNU’s teaching credential programs are ideal for second-career teachers. Class start times are designed for working adults. The campus is centrally located for San Francisco-Silicon Valley workplaces and/or residences. Classes are small in size, and there is a strong collaborative spirit that supports returning students.

Extensive Alumni Network

Notre Dame de Namur has a long history in the field of teacher education. NDNU alumni work as administrators, principals and teachers throughout the Bay Area and California. This network provides a valuable resource for those seeking teaching jobs and student teacher placements.

Request Information on Notre Dame de Namur University Teaching Credential Programs

There are special grants and financial aid available for students going into teaching, so make sure to explore these opportunities for assistance in paying for college.