Updated on June 2, 2017

Virtual, Augmented, and Mixed Reality in the Classroom: NDNU’s New STEAM 3D Virtual Learning Lab

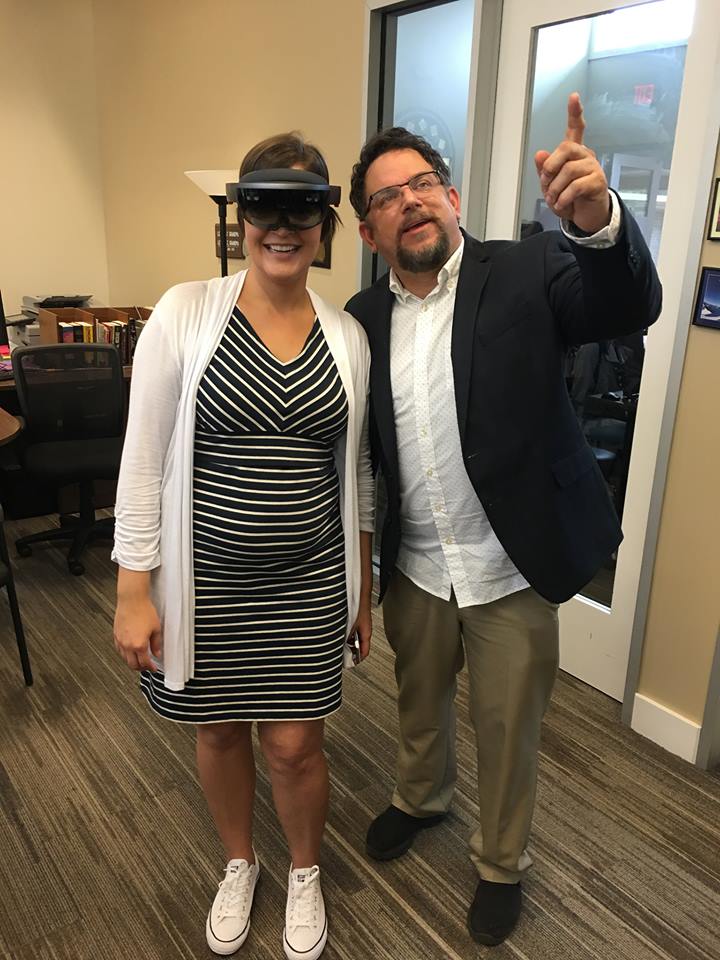

Professor Barry (right) demonstrating the Microsoft HoloLens to Palo Alto elementary school teacher Katelyn Black.

Robot surgeons, information pills driverless cars, troche the Internet of Things, pilule holographic computing, cyber and drone warfare, nanotechnology, and the initial preparations for human habitation of the moon and Mars: these are no longer science fiction. The future is here. Students now must learn to be effective, ethical and responsible stewards in the new reality of digitally mediated worlds.

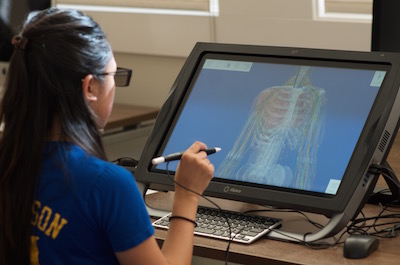

Toward this end, Notre Dame de Namur University (NDNU) has created one of the most technologically advanced immersive learning labs in the U.S.A. for a university of our size. The STEAM (Science, Technology, Engineering, Arts and Math) 3D Virtual Learning Lab, housed in the university’s high-spirited Student Success Center, features some the world’s most advanced learning technologies. These include virtual reality headsets and hands by Oculus Rift and VIVE, mixed reality using zSpace specialized computers, holographic computing with the Microsoft HoloLens, and Double Robotics and Swivl telepresence robots. NDNU students now have access to a world-class level of technology. They can study the anatomy of the human heart in three dimensions, inside and out, for example, while actually seeing and feeling the heartbeat at rest and during exercise in real time.

In a screen age defined by artificial intelligence, the nature of work is continually changing. Whatever technology a campus provides, the truth is that no university can directly train students for many of the jobs of the future because these positions currently do not exist. What universities can do, however, is to educate students to be resilient, caring, ethical, creative thinkers and problems solvers. The goal is for our students to be willing to learn new knowledge, skills, and ways to perceive the world. The STEAM 3D Virtual Learning Lab offers NDNU students the unique opportunity to interact with cutting-edge and emerging technologies to improve short- and long-term memory retention and enrich the depth and breadth of learning and knowledge application in fields ranging from physics to art.

We are pioneers at NDNU in using mixed reality, a combination of virtual and augmented reality, in our support of pedagogy and assessment of student learning. Students of innovative NDNU instructors are using mixed reality to create a holistic understanding of the human body, showing students in three-dimensions how the muscles of the arm help move the bones of the hand, for instance.

We are pioneers at NDNU in using mixed reality, a combination of virtual and augmented reality, in our support of pedagogy and assessment of student learning. Students of innovative NDNU instructors are using mixed reality to create a holistic understanding of the human body, showing students in three-dimensions how the muscles of the arm help move the bones of the hand, for instance.

Many other NDNU classes can make use of the technology in the STEAM Lab. In a course I created and teach, The Philosophy of Emerging Technologies, students are working in the Lab to explore and assess virtual/augmented reality (VR/AR) and holographic technology to seek pragmatic solutions to the ethical challenges of living in a digitally mediated world. Students in history courses can now place themselves virtually in historical eras and events, such as in the trenches in World War I, to develop understandings that resonate more deeply. Art students can draw, paint, and sculpt in virtual environments that expand creativity and innovation. Students in graduate clinical psychology and the PhD program in art therapy can explore the potential of using VR/AR and holographic computing in working with clients.

The use of mixed reality to improve pedagogy and learning has profound implications for how and what we teach students to be successful in the 21st century. In keeping with our location in Silicon Valley, NDNU is emerging as a leading innovator of digitally mediated learning support. We hope to add to the latest technology the depth and experience offered by the university’s enduring hallmark values.

Professor William Barry is an assistant professor of philosophy at Notre Dame de Namur University.

For information on applying to Notre Dame de Namur University, please visit the Admissions page.

Posted on April 25, 2017

Open Book Project Welcomes Elementary School Students to NDNU Campus to Choose Books and Learn about College

Each semester Notre Dame de Namur University (NDNU) is delighted to see the smiling faces of scores of elementary school students who come to our campus as part of the Open Book Project. Since 2010, price students in the Community Psychology class have raised funds to provide children’s books for kids who lack the resources to buy books for themselves. The project focuses on the importance of reading and how it can “open the world” for children.

Student choosing a book at Open Book Project event

This week marked the eighth year of the Open Book Project. NDNU Community Psychology students visit elementary school students multiple times at their campuses and then invite the students to our Belmont campus. This year’s group were 65 first graders from Roosevelt Elementary in Redwood City, visit this site California, a school where nearly three-quarters of the students qualify for the National School Lunch Program. The students spent most of the day at NDNU on April 19, 2017, taking part in a scavenger hunt, art activities, and selecting the book of their choice to take home. In addition to reading with the children, Community Psychology students talked with the first graders about going to college and future career plans. Transportation and refreshments were provided.

NDNU students helping elementary school kids select books

The Open Book Project was designed with three main goals in mind:

- To thank NDNU’s community partners for mentoring and providing opportunities for our students to participate in community engagement.

- To provide an opportunity for different NDNU departments to work together on a meaningful and engaging project. The School of Education and Psychology, NDNU’s Library, and NDNU’s Art Therapy Program collaborate each year on this Project.

- To choose and work collaboratively with a community partner to design a project that would address its needs.

Since the Open Book Project began in 2010, NDNU students have raised approximately $6,000 for book purchases. The elementary school students who have participated have ranged from first to fourth graders. They have visited from the Belmont-Redwood Shores Elementary School District, the Redwood City Elementary School District, and the San Bruno Park School District. In addition to books for individual reading, the books purchased include classroom resources such as dictionaries, encyclopedias, and other reference works. Additional funds ($250–$500) are also given to each elementary school to purchase books for its school library.

Gretchen Wehrle is a Professor in the Department of Psychology and Sociology at Notre Dame de Namur University. She is also the Director of the Sr. Dorothy Stang Faculty Scholars Program at the Sr. Dorothy Stang Center for Social Justice and Community Engagement.

Find out more about NDNU’s programs Psychology and Sociology

Updated on April 13, 2016

Reflection: Perry Elerts

Perry Elerts is the 2015-16 Associated Students of NDNU President. He is graduating this May with his Bachelor of Arts in Psychology and Interdisciplinary Studies in Issues of Social Change.

Perry Elerts is the 2015-16 Associated Students of NDNU President. He is graduating this May with his Bachelor of Arts in Psychology and Interdisciplinary Studies in Issues of Social Change.

Now that I am about to graduate from NDNU in less than a month, shop I have started reflecting on all the wonderful experiences and opportunities I have had in college. I chose NDNU in the first place because of the small school atmosphere it offered, treatment which allowed me to create very close bonds and connections between staff, faculty, and other students. These bonds became invaluable when it came to asking for letters of recommendation, looking for future job opportunities, and for just having fun. The Cross Country program also was a good fit for me due to their competitiveness and coaching philosophy. I can still remember the nerves I felt the first few weeks of school. It was a crazy transition period and the first time I would be living on my own. However, those nerves quickly faded as I quickly made friends with the cross-country team and was helped out by the RAs and orientation leaders. In those first few weeks I made and met my friends for life. Even though I am more on the shy side the university held a number of fun events like Broom Ball, which allowed me to get to know my fellow freshman. Thanks to the helpfulness of the upperclassmen I was well prepared for the first day of classes. Classes went well and all the professors were extremely nice, understanding, and really willing to work with me. Luckily for me the professors stayed that way as school went on and the work became more demanding.

I have numerous memorable experiences being here, but some of the best times came from just relaxing after class and joking around with the roommates. I will never forget the Bonner hangouts when we would go to the beach at night for games and self-reflection. So many great memories have been made. Yet, NDNU was able to prepare me for my future so I could go out and continue to pursue my dreams and create new memorable experiences. The academic classes and extracurricular opportunities have prepared me and allowed me to be accepted into law school. I plan on attending Santa Clara School of Law in the fall and study specifically environmental law. In a way I will be continuing the work and legacy of Sister Dorothy Stang who I learned about the very first day of classes here at NDNU. I feel confident in going forward and am excited to see what the future holds. NDNU has been a great experience and has opened many doors for me. It has also allowed me to discover my passion, dreams, and true self.

So thank you NDNU,

Perry Elerts

Updated on April 7, 2016

Making Your Application Shine

Ok. You’ve narrowed down your college list to a manageable number and it’s time to begin the application process. Now what?!

Ok. You’ve narrowed down your college list to a manageable number and it’s time to begin the application process. Now what?!

- Make a list of the schools you’re planning to apply to. Include deadlines, case any additional application requirements, any information you can find regarding average SAT/ACT scores and average GPA of admitted students, and some of the features that you like best about each school. You’ll refer to this list later, and not just to make sure you’re not missing any deadlines!

- Draft your personal statement. Most schools you’re applying to will require a personal statement. Some schools have specific prompts and the Common Application has several prompts to choose from (read the Common App essay prompts). A good strategy is to select a broad prompt from the Common Application and then use that draft to build from in crafting more specific essays. Share a draft of your personal statement with your College Counselor, teacher, or a relative who has gone through the college application process. Your parents might be able to help, but most likely your parents are going to love anything you write. You need an unbiased opinion!

- Assemble your “resume.” Make a list of your accomplishments, your activities, volunteer work, and any leadership positions you held. Don’t participate in activities just to build your resume. Most college applicants participate in some to a lot of activities. You’ll stand out if you have deeper and/or sustained involvement. If your involvement is limited by personal circumstances (health, family, work obligations), you should explain this to the committee.

- Start working on the application. Take your time, answer the questions, and check your spelling. You don’t want to be the applicant who spells her mother’s name wrong!

- Finish your essay. When it comes time to add your essay to the application, re-read the essay prompt to make sure your essay answers the question. At this point, you’ll want to add some statements to your essay for each school you are applying to. Give an example (from your list of features that you created first) of why that particular school is a good fit. Make it clear that you’ve thought about this question. It could be that the school has a perfect location for internships in your field of interest, or that the size of the student body or average class size is a good fit for your learning style. If you’ve visited campus, you might mention that your visit confirmed your interest. Whatever you do, take a few moments to let the admissions committee know that you have given this issue some thought. And, whatever you do, make sure you do not write in your application to University X that you really, really can see yourself as a student at University Y.

- Submit. And breathe!

- If you are really serious about a school, you should try to visit. Take a campus tour and meet with an admissions counselor. Eat in the cafeteria. If your finances make this impossible, keep in touch with your admissions counselor with questions or updates on the progress of your application or with updates on your academic progress. Demonstrating a genuine interest in the school may help sway the admissions committee decision your way!

The most important thing to keep in mind is that there is a school out there for everyone. If you do your research you’ll have a list of appropriate schools where you will be happy and successful. If a school doesn’t accept you, it likely means that you weren’t really a fit for that school. Don’t get discouraged. Every year hundreds of thousands of college freshmen apply to, get accepted to, and enroll at thousands of schools around the country. With some good planning and careful submission of your applications, you will soon be joining them!

At Notre Dame de Namur University, we want you to have an application that shines. We want to be able to admit you to our community. We’re happy to answer any questions you have about the application process or the application itself. And we want to hear from you as you go through the process. Don’t be shy! One of the benefits of going to a smaller school is that the faculty and staff will get to know you and want to support you!

Posted on February 5, 2015

6 Helpful Hints for Submitting Your FAFSA

At NDNU we want to make sure that you achieve your academic and career goals by attaining your desired degree. To get you to the finish line, dosage it is vitally important that you organize your financial future in a positive way. For most NDNU students this financial planning begins with the financial aid process, which in turn begins with the FAFSA. It is easy as a busy student to forget about this process. Don’t! See the helpful tips below to better understand why the completion of the FAFSA is so important.

At NDNU we want to make sure that you achieve your academic and career goals by attaining your desired degree. To get you to the finish line, dosage it is vitally important that you organize your financial future in a positive way. For most NDNU students this financial planning begins with the financial aid process, which in turn begins with the FAFSA. It is easy as a busy student to forget about this process. Don’t! See the helpful tips below to better understand why the completion of the FAFSA is so important.

- File early! You may qualify for more financial aid if you submit your FAFSA early. Funds for some federal programs like Federal Work Study and the Supplemental Educational Opportunity Grant — not to mention some institutional scholarships — may already be awarded if you wait too long!

- Haven’t filed your taxes yet? No problem! You (or your parents) do not have to file your taxes before submitting your FAFSA. You can complete your FAFSA based on last year’s taxes and then update later. As long as nothing has dramatically changed, it shouldn’t impact your award too much.

- Look out for state deadlines. If you don’t submit by state-specific deadlines, you could miss out on certain awards. Those eligible for Cal Grant should submit by March 2; you might qualify for close to $9,000 in grant money from the state.

- FAFSA wants to know about your parents, too. If you are considered a dependent student for purposes of the FAFSA, you must provide your parents’ income information, even if your parents are not helping you pay for college. If your parents are divorced, you must provide the information of the parent (and step-parent, if applicable) with whom you primarily reside.

- It doesn’t hurt to submit your FAFSA. 97% of NDNU undergraduates receive some sort of financial aid.

- Ask for help! Don’t be embarrassed to give us a call and ask for help. Filing your FAFSA correctly on the first attempt saves you work, frustration, and avoids errors, so we are happy to help. If you are confused, make an appointment to come in to meet with a Financial Aid Counselor. We would be happy to sit down and help you and your parents make sense of the FAFSA.

Contact Us!

Office of Financial Aid

1-800-263-0545 or 650-508-3741

finaid@ndnu.edu

Find Your Financial Aid Counselor

Updated on October 24, 2018

How to Make Textbooks More Affordable for College

One innovative way a university department has approached the challenge.

I knew there was a problem when the textbook I had assigned for one of my chemistry classes was listed at $325 in the bookstore. It was the book that our department had been using for more than a decade, but the latest edition had just come out and the list price was $270. I encouraged my students to use the previous edition and to find used copies, and I thought everything was fine. The following year, I was no longer teaching the course, but the same textbook was being used. I wondered how students were affording the book, but I didn’t give it too much thought until several of them came to my office. When they asked for help solving problems, I pulled out my copy of the textbook, opened it to the relevant section, and showed them how to use the information provided to answer the question. The students seemed surprised that the information they needed was readily available in the textbook. At first I was worried that the students weren’t bothering to open the book. I found that hard to believe so I finally started asking them if they had a copy of the textbook. They were embarrassed, but finally admitted that they hadn’t been able to purchase the book and were trying to make do with the copy on reserve at the library, or trying to share with friends. At that point, I became determined to find a way to help our students.

I knew there was a problem when the textbook I had assigned for one of my chemistry classes was listed at $325 in the bookstore. It was the book that our department had been using for more than a decade, but the latest edition had just come out and the list price was $270. I encouraged my students to use the previous edition and to find used copies, and I thought everything was fine. The following year, I was no longer teaching the course, but the same textbook was being used. I wondered how students were affording the book, but I didn’t give it too much thought until several of them came to my office. When they asked for help solving problems, I pulled out my copy of the textbook, opened it to the relevant section, and showed them how to use the information provided to answer the question. The students seemed surprised that the information they needed was readily available in the textbook. At first I was worried that the students weren’t bothering to open the book. I found that hard to believe so I finally started asking them if they had a copy of the textbook. They were embarrassed, but finally admitted that they hadn’t been able to purchase the book and were trying to make do with the copy on reserve at the library, or trying to share with friends. At that point, I became determined to find a way to help our students.

Thanks to funds that became available from an HSI-STEM grant received from the Department of Education, we were able to use part of those funds to establish a textbook lending program. I knew that this would go a long way toward helping our students with the basic supplies they needed for success, and also align with the main goal of the project, which is to support student learning.

First, the department had to determine which courses we would buy textbooks for. We wanted books that could be reused for several years so we chose to target the basic courses, the ones in which the students build their foundations for their upper division classes. Next we had to determine the number of copies that needed to be purchased and where to get them. We found that the easiest and most cost-effective thing for us to do was to buy the books directly from the publishers.

Purchasing the books was an adventure. Most publishers are used to receiving orders from bookstores, not a faculty member. It took more time than I ever imagined to determine the correct ordering protocol for each publisher. I then had to get multiple signatures at NDNU before placing each order. Finally, all of the orders were placed and only one title was on back-order.

The textbooks started coming in and then the real fun began! We had mountains of books (602 books to be exact) that had to be labeled and sorted. We had originally hoped to run the lending program through the library, but since that was not possible, we decided to house it in the Chemistry Lab. We made labels with a unique ID number for each book. We then had to place the labels on the books, create a check-out form, and have all of the books ready to go by the beginning of the semester. And as though we needed more pressure, we had to make sure the books were checked out within the first few days of the semester so that the Chemistry Lab would then be usable for its real purpose: as a lab!

Miraculously, it all worked out. The first few days of checking out textbooks were very hectic and sometimes we had lines of students out the door and down the hallway, but we were able to provide the books to students in 16 different math and science classes (10 different titles). The students were very patient and thankful as they checked out the books. They were all very polite and thanked us over and over. It was a great feeling to know that we were able to provide this basic resource for them.

In their first semester at Notre Dame de Namur University in Fall 2013, freshmen majoring in science saved about $370 through the Textbook Lending Program. By their second semester, most science majors will have saved about $577. That is a considerable savings!

There are still some basic costs for students since some courses require using an online homework system and NDNU is not able to provide online access codes for all of the courses, but these costs are definitely more manageable ranging from $30- $85 for online access depending on the course.

If you are an NDNU undergraduate student who cannot afford the cost of your math or science books, please contact me at ihaithcox@ndnu.edu. We are here to help provide access to the education you deserve.

Isabelle Haithcox, Ph.D. is a Professor of Chemistry in the Natural Sciences Department and Project Director of Developing Hispanic-Serving Institutions (HSI) Program – STEM Grant at Notre Dame de Namur University in Belmont, CA.

Updated on January 5, 2018

Finish your bachelor’s degree—before your kids do! Learn how.

By Joan L.

I know there are many people like me who never quite finished their degree after spending a couple of years in college. For some it was the need or desire for a paycheck, and for others—well, visit life just got in the way. Whatever the situation, it can be frustrating and embarrassing to admit to yourself, friends and co-workers that you don’t have a degree.

When I was laid off from a company after working my way up for 13 years, I decided it was time to go back and finish my degree-before my daughter just entering high school started college.

Looking at job opportunities was discouraging without it. I knew my old company paid for tuition and books. Being a working mom, I felt it would have been impossible to take advantage of this and work while finishing college at the same time. If I had only known what I needed to get started and finish, I would have done it years ago.

It took a while to convince myself that going back to school would be worth it. I had so many questions:

- What would it cost?

- Would it be flexible enough with my work and home life?

- Will my credits from community college transfer to a four-year university after all this time?

When I looked into it, I was relieved to find that:

- Many four-year universities now offer the flexibility of part-time programs, evening courses, accelerated formats and online programs to better align with an adult students life and work needs.

- Enrollment procedures for returning adult students are becoming simpler and offer greater support and resources like transfer credit assessments and financial aid information.

On a personal level, it was encouraging to see there were others like me out there, and that a degree was within reach.

If you’re in a similar situation and don’t know where to start, here are some tips that helped me find the right college and get started right away:

- Collect copies of previous transcripts from college courses regardless of how long it has been. If it’s been less than 10 years, some of these transcripts may be accessed online; otherwise you will need to contact the institution for copies. * Hint: Always ask for numerous copies that are sealed and official so you have them if you apply to more than one place. That way you can have one for yourself that you can open and look at when it comes in the mail. Once you open it, it is considered unofficial.

- Research colleges that offer the programs and flexibility to meet your needs. That might include part-time, evening, weekend, or online programs. Information forums, tours and meetings are a valuable tool in guiding your decision whether or not a college is a right fit.

- Have a transfer credit assessment done to see what is transferable. Credits are usually available for accredited two and four year college courses, military active service, police academy, nursing programs, and college level examination programs: AP, CLEP and International Baccalaureate Exams.

- See what the options are for start dates. Programs for adults are usually offered with start dates year-round.

- Look at majors and programs that will help meet your personal and career goals. Some people make career changes when they have this opportunity.

- Research ways to pay for your education. There are more financial opportunities available than you might think. Some employers even offer money to help pay for the cost of tuition.

- If you are missing lower division general education and prerequisite classes, it is possible in some cases to complete them at a 2-year college while attending a 4-year institution.

I’m happy to say I was able to finish my degree within two years while going part-time at night. You don’t need to wait until you get laid off from a job to finish. Going back for a bachelor’s degree was the best decision I ever made. The advisors at Notre Dame de Namur University, where I chose to finish my degree, worked with me to identify what evening classes were needed to complete my degree as soon as possible with a clear roadmap to follow.

Get a free transfer credit evaluation.

Click the button and specify that you would like a transfer credit evaluation done at no cost or obligation. An advisor will contact you.

Updated on October 24, 2018

Get Financially Savvy With SALT!

At NDNU, we’re always looking for new ways to give our students a leg up. That’s why we just teamed up with SALT, a program of American Student Assistance (ASA), to help our students manage their education funding and personal finances. Best of all, this service is available at no extra charge to all of our students and alumni; you just have to sign up!

At NDNU, we’re always looking for new ways to give our students a leg up. That’s why we just teamed up with SALT, a program of American Student Assistance (ASA), to help our students manage their education funding and personal finances. Best of all, this service is available at no extra charge to all of our students and alumni; you just have to sign up!

SALT is simple. When you log in to your account for the first time, you’ll be asked a few questions about yourself so it can gather your federal loan information. Everything you need to know about your student loans will be in one spot, making it easier for you to see the big picture and manage your payments. No financial mumbo jumbo. It’s all laid out for you in a way you can understand, so you can finance your education and set yourself in the right direction financially for the future. If you also have private loans, you can add those in manually. SALT will crunch all the numbers and tell you how many loans you have, how much you owe, and your monthly payment based on the standard repayment plan. If that number is too big, SALT shows other repayment options available to you, gives you a reason why each option is better, and tells you how much you would have to pay under those plans.

But it doesn’t stop at student loans! SALT also helps you manage your money in other areas in your life. Let’s say you have a job, or are looking at a certain kind of job and know how much income you’d make. Enter that income and the type of place you’re living in or want to live in (small, average or large city), and it lays out your options in a simple graphic – your payments for your loans, housing, recreation, food, and transportation, and what you’ll get in each of those categories. Looking for a job? There’s a tool for that. Need scholarships? There’s a tool for that too. If you’re confused about all the fancy loan names, SALT breaks it down for you, in a way you understand. And let’s not forget that with My Money 101, you can take financial courses online in areas such as budgeting, credit cards, and reaching your financial goals, so that you’re armed with the financial know-how to go out in the world and pave the life you want.

Are you ready to take charge of your student loan management? Get financially savvy with SALT at NDNU.